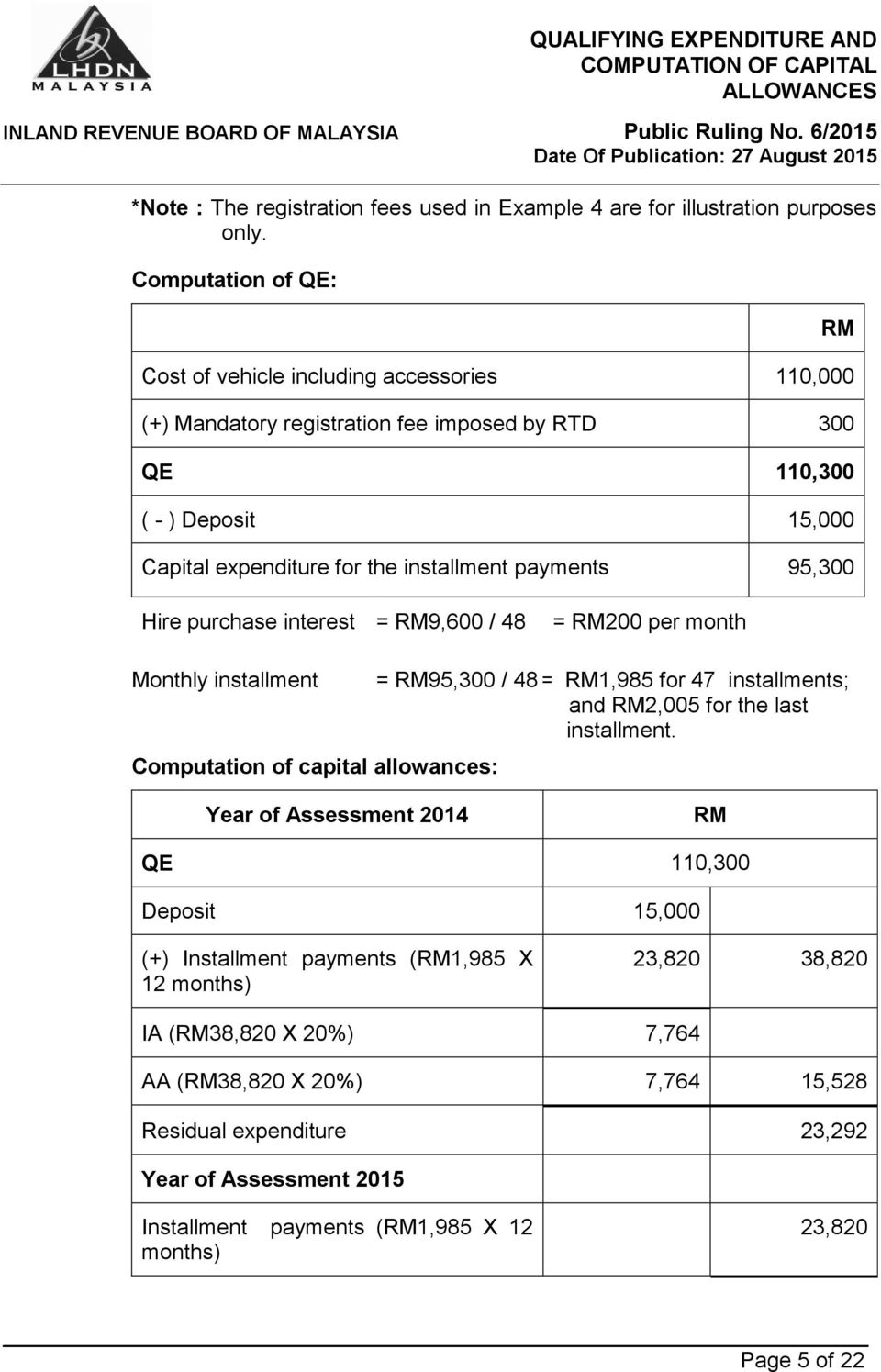

Capital allowance rate malaysia 2021 - Capital Allowance Types and Rates

Malaysia: Finance Act 2021, effective 1 January 2021

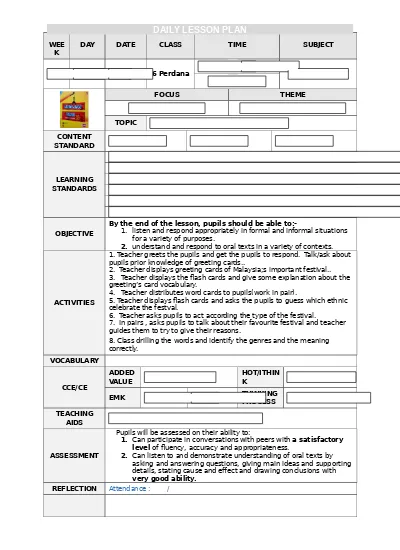

Due to lack of understanding, the majority of taxpayers eligible to claim capital allowances on these capital assets do not claim their full entitlement and therefore fail to enhance their claim.

Care will need to be taken to consider the optimal capital allowances claim and the significance of any potential liability on the disposal of the assets as this will vary depending on the level of qualifying expenditure.

This article talks about capital allowances in Malaysia.

Budget 2021: Capital Allowances and the new super

Conclusion Overall the new allowances provide an attractive incentive for businesses looking to making capital investments in the short-to-medium term.

Besides that, the recent changes on Form E guideline has also stated all type of employment with the Company include permanent, intern, part-timer and contract wages has to be declared.

If the disposal occurs in a chargeable period that ends before 1 April 2023, the balancing charge is equal to the disposal value multiplied by the relevant factor of 1.

2022 qa1.fuse.tv